If you work 37.5 hours a week, should you be able to enjoy a good quality of life? What even is a good life for someone living in the UK?

The blog post follows Carol and Edward, a typical couple in the UK, from when they begin renting in their early 20s right through until retirement, raising 2 children over that period. It looks at the decisions they need to make, and when, to support what could be considered a good quality of life.

This blog post has been created through a modelled scenario on MyFinance. If you too want to plan your finances and like what you see in some of the visuals, you can sign-up and get started for free.

Good Quality of Life

So what is a good quality of life? There is no clear definition, but given a significant portion of happiness is derived through economics, it could at least require:

- Each month, after bills, savings, etc. you should be able to go the cinema for a weekend date, for breakfast with the family or purchase a video game.

- You, and your children, should not be dependent on parents financially. Whether that be getting on the housing marking or for childcare.

- If your washing machine breaks or you need repairs to the roof, you shouldn’t be laden with years worth of debt and subsequent interest.

- You should not have to choose between enjoying life now (within reason) or saving for your retirement. If you want to go on holiday each year as a family, you should be able to.

Above all, maintaining a good quality of life shouldn’t be dependent on getting into debt. Debt is not a bad thing, but at all times it should be a choice.

Edward & Carol

Carol and Edward live in the North of England and are a fairly typical couple. Throughout their life, they earn 10-15% above minimum wage in full time jobs. They’ll go on to get married and have 2 kids who’ll stay at home until their early 20s. Having met at college, Edward and Carol have decided to live together, but like many couples, they can’t afford a house. They are therefore renting a 1 bedroom apartment that they hope to stay in whilst they save for a house.

Saving for a House (5-6 years)

We join Edward and Carol at the kitchen table of their apartment where they’re working out what sort of house they can afford; the deposit they require and how much the monthly mortgage payment will be. Edward and Carol are still young and enjoy going on holiday, date nights and spending time catching up with friends and family at a local cafe every other weekend. As they look to being saving for a house, they’re keen not to sacrifice on the quality of life too much.

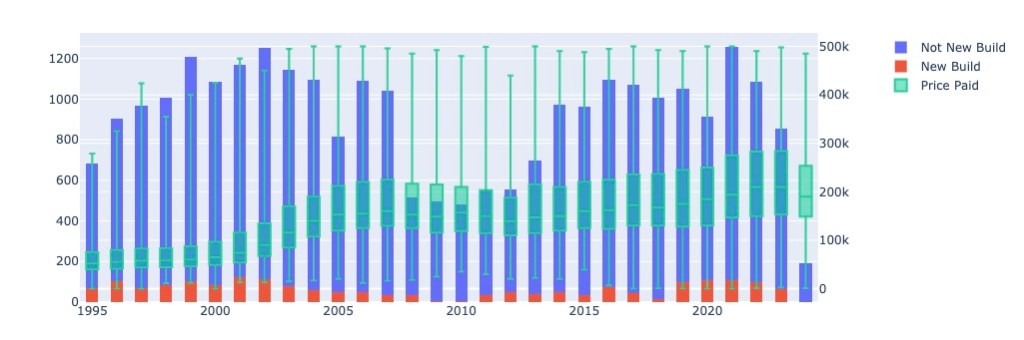

Carol and Edward begin looking at properties in the North of England where they live and can see that the median house price is around £200,000.

Based on current mortgage deals, this means they’ll need a 10% deposit (£20,000) and are looking at a monthly mortgage payment of around £1,000 a month. Carol and Edward are currently renting a property for £850 and so the monthly mortgage payment isn’t too much of a stretch. As for most first time buyers, the challenge is saving for a deposit.

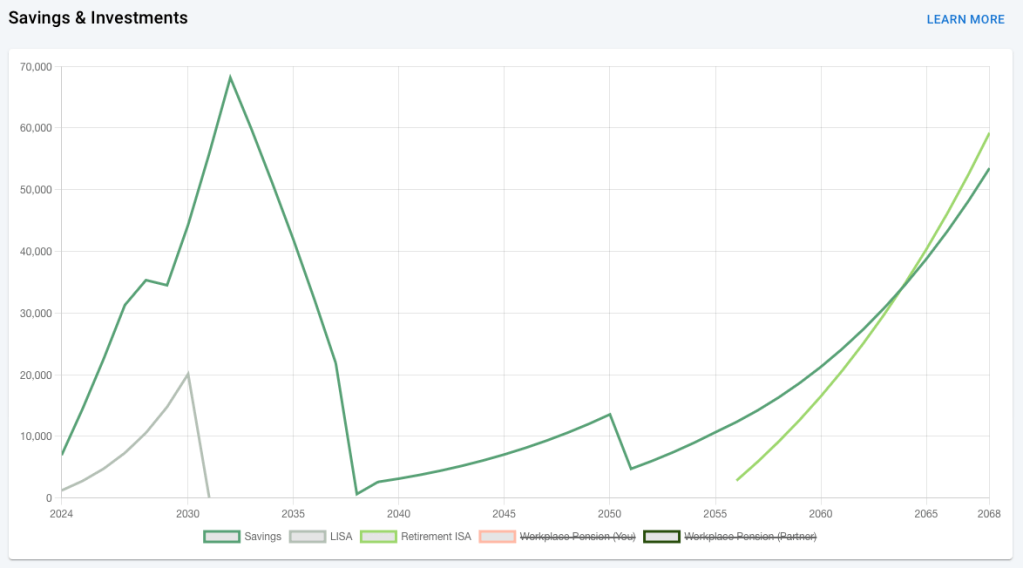

They work out that over the next 7-8 years, if they save £1,800 a year into a government LISA with a 5% return and a 25% government bonus, they will be able to afford a deposit on a house in the local area.

But a house is not the only significant expense coming up on the short term. Edward and Carol are also hoping to get married in the next 5-6 years. If they save £1,500 a year towards a wedding, they’ll be able to afford a basic wedding. Their finances over this period are summarised below:

| Finance Type | Amount (Annually) |

|---|---|

| Income (after Tax) | + £43,000 |

| Expenses | – £27,000 |

| Savings (incl, etc.) | – £14,000 |

| – Deposit | £1,800 |

| – Wedding | £1,500 |

| – Pension | £2,500 |

| – General (Holidays, future, etc.) | £8,200 |

| Loans & Credit | – £0 |

| Disposable | £2,000 |

The astute reader will notice total annual general savings of £8,200 a year. What is all this money going towards?

Carol and Edward have been talking about also potentially starting a family once they’re in their new home. Due to not having the support of family for childcare, they would like Carol to take a period of leave (approximately 6 years) from their career to see the children into full time education.

Looking at their finances over this period, they work out that even with child benefit, maternity pay and some part time work, they’d get in to almost £60,000 worth of debt (excluding interest). They’d also take a hit to their quality of life, forgoing things like holidays and many home improvements.

The £8,200 is therefore to enable Edward and Carol to build a buffer of almost £60,000 over 8 years, allowing them to have and raise children whilst not paying almost thousands of pounds in interest paying off £60,000 worth of debt over many years.

This is a really interesting point. Carol and Edward must start saving for the early years of their children at least 8 years before they even have them. If not, it’s in this period of life that they would either fall into a life changing amount of debt or become reliant on the state, neither of which should be outcomes to achieve the basic goal of raising a family.

Buying a House and Future Proofing (1-2 years)

After 6 years, Edward and Carol have managed to save, via their LISA, £20,000 to put towards a house. They purchase a house in their local area for £220,000, taking on a mortgage of £200,000 at 4.1% interest. Their monthly payments being approximately £1,000.

Now in a house and ready to start a family, with savings to enable them to do so, Edward and Carol turn to their retirement. Buying a house and raising a family has required almost 10 years of future planning, how long does it take to prepare for retirement?

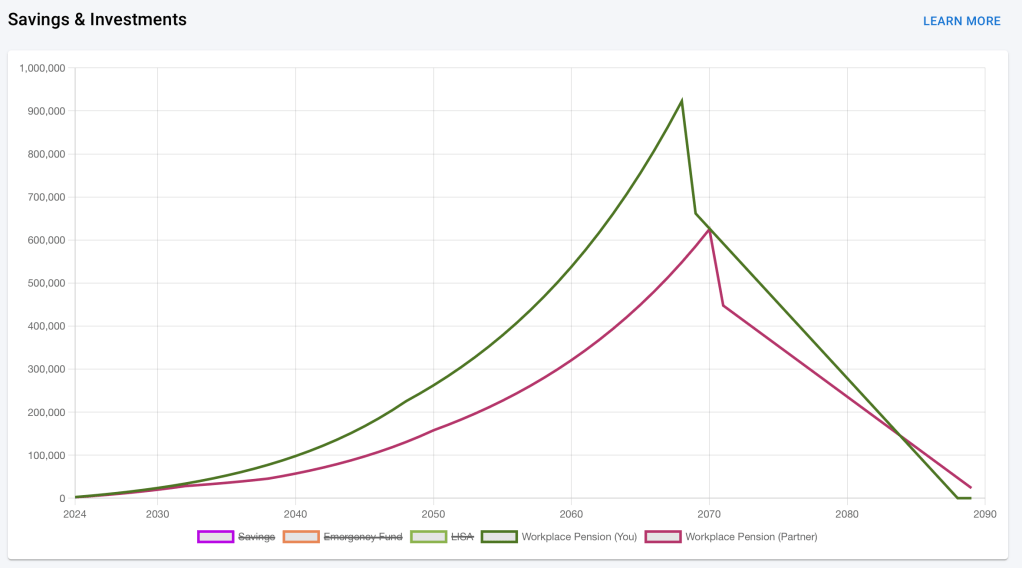

Over the past 10 years, Carol and Edward have both been contributing the minimum amount into their workplace pensions (a combined employee / employer contribution of 8% of earnings). If they continue like that, they estimate they’ll have a combined retirement income worth around £1.5million. Retiring at 65 and with an average lifespan of 85 years, this must last them 20 years.

In today’s money, they would be able to take approximately a £150,000 lump sum and pay themselves £20,000 annually. With their mortgage having ended by the time they retire, this will see them through.

Using a tool such as MyFinance, they’re able to model inflation and other factors into their retirement planning to see what sort of income that will give them.

Raising a Family (21 years)

Carol and Edward have given birth to 2 children and whilst their quality of life has certainly taken a hit, their financial planning at least means it’s expected and planned for.

Once the children start school, Carol goes back into a similar full time job as before. Both Edward and Carol are lucky enough to have employers that support flexible working meaning that, again, they do not need to rely one expensive before and after school clubs. Their financial situation and therefore quality of life also improve during this period, giving them more disposable income each month (~£250) and allowing them to resume going on modest family holidays each year (~£1,500).

It’s at this point in life where decisions such as deciding to remortgage, move home, etc. all become potential options. Or more generally, a point at which deciding to take out loans (that come with interest) could be considered. Edward and Carol decide that if they remortgage and take £20,000 – £30,000 out of the house, they can use this to spruce up the family home. The effect of which is an extra £5,000 of interest paid on their mortgage.

It’s also through this period that their savings buffer of at max £10,000 can be used as both an Emergency Fund (replace the washing machine, etc.) and to support their children with activities such as learning to drive.

Back to Two (15 years)

Edward and Carol are now nearing their 50’s and the kids are leaving home. There’s still another 15 years to go until retirement and it’s during this period that money becomes a little easier. Not only is there less money being spent on expenses such as food, but the mortgage is coming to an end.

Whilst Carol and Edward haven’t been living month to month over the past 20 years, they’ve lived a modest life. They decide to enjoy themselves a little more during this period, going on some once in a lifetime holidays and reconnecting with some old hobbies. But additionally, it’s within this period that actions can be taken to bolster retirement.

In their mid 20s, they had planned for their retirement by modelling how their workplace pensions would support them. They’ve always wanted to stay in the family home for as long as possible, so they’d rather not take equity out of the home or downsize. But they’re aware that things like the State Pension are not guaranteed and so they consider what mitigations they can take. They could either contribute more into their pensions, or diversify with some more accessible investments through an ISA. This is what they decide to do, investing in a mix of bonds and shares through a managed fund.

Retirement (20 years)

Carol and Edward have now retired. They’re living comfortably in a house they own outright, they have £200,000 in the bank from savings and pensions lump sums as well as a small ISA. They’re able to spoil their grandkids, go on a number of holidays each year and enjoy their hobbies.

So What?

This is a modelled scenario where not a lot deviated from the plan. Throughout their life, Edward and Carol have enough of a savings buffer (an Emergency Fund) to cover any mishaps such as broken cars or home appliances, they’re living in the North where property is cheaper and they remain a couple with 2 income sources. But clearly life rarely goes like this.

So given this is the “happy” path, is the life that Edward and Carol have had acceptable for a hard working family in the UK? Should parents have to plan almost a decade in advance to support the early years of their children?

What if you live in the South or you’re single? Whilst this blog does not go into detail regarding those scenarios, it’s probably not hard to see that they’re largely unachievable.

There are a number of government initiatives that support Carol and Edward throughout their lives that we must continue to support. Lifetime ISAs (and the broader ISA allowance), auto-enrolled workplace pensions, new legislation around flexible working and further education programmes such as Skills Bootcamps are just a few.

But other support such as a Single Persons Tax Allowance (I’m not sure the Single Person Council Tax discount is enough), Home Improvement Grants (to enable people to purchase cheaper houses that require work that they can start instantly), 100% mortgages (with more stringent lender checks) and renters schemes (that essentially don’t punish people who can never build equity in a property) are all super important.

Above all, it’s incredibly important all households are equipped with the basic ability to manage their finances, both in the short term, but also the long term. Apps such as MyFinance are a step in that direction, but must be accompanied by financial education both in schools and the workplace.